Oxford Students Come Together to Pay Lunch Balances

Published 4:15 pm Tuesday, March 30, 2021

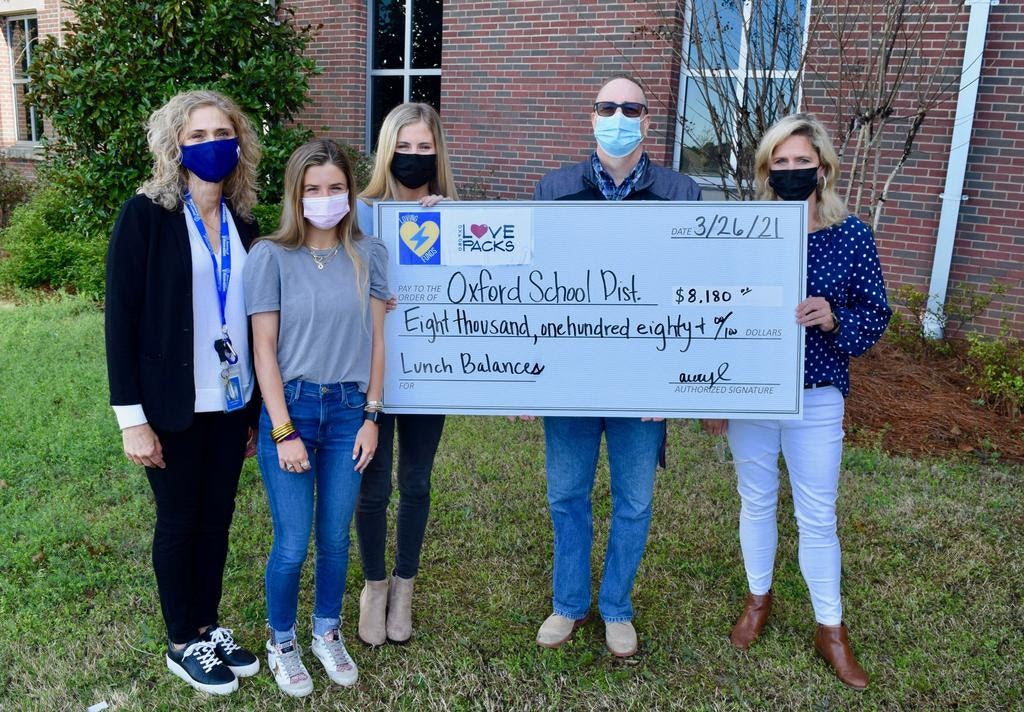

- Loving Funds presents check to Oxford High School to forgive lunch debts at Oxford High School. Pictured Left to Right: Camie Bianco, Ellie Tucker, Avery Langley, Noah Hamilton, Dr. Nikki Logan. (Photo Contributed)

School meal balances are a problem that can prevent students from many end-of-year activities. But even with inexpensive meal programs, parents can fall behind on lunch debts.

Oxford High School junior, Avery Langley, saw a need and created Loving Funds – crowdsourcing $8,180 to prevent Oxford students from enduring further penalties.

“I was trying to help a classmate with a different issue and realized her old lunch balance was a problem that could prevent her from walking in her own graduation ceremony. We don’t always know the truth about a student’s financial stability, but I wanted to find a way to help. Loving Funds is not about just handing out money, I want to help our classmates apply for the Free and Reduced Lunch Program so they know it’s private and not publicized to cause embarrassment. Eating a meal at school shouldn’t prevent a student from being able to enjoy their graduation,” said Langley.

In the fall, Langley launched Loving Funds with the help of a peer, Ellie Tucker, and they quickly realized that they needed help with housing these funds. That’s when LovePacks stepped in with a similar mission- feeding children. “It’s a lot of work to become a 501(c)(3) but we knew we could partner up with Avery and house the money for the project until she was ready to cut a check to the school. Avery did the work, LovePacks just supported her by receiving the donations,” said Camie Bianco. For many years, Langley’s family has volunteered with LovePacks and More Than a Meal, two local non-profits that provide food to Oxford and Lafayette County families who face food insecurity.

Forty-three percent of Oxford School District’s students qualify for free-and-reduced meals. Due to COVID-19, the USDA provided free meals to all students for the entire 2020-2021 school year. Loving Funds provided forgiveness of debts carried over from the 2019-2020 school year.

Loving Funds is a designated fund of Love Packs and is a qualified tax/exempt Corporation under section 501 (c) (3) of the Internal Revenue Code and, therefore, contributions are tax-deductible for donors. Donations continue to be accepted by Love Packs on behalf of Loving Funds by check and Venmo (@Love-Packs).