Mississippi Senate proposes $446.6M tax relief package

Published 3:31 pm Tuesday, February 1, 2022

- (Photo: Pieter van de Sande/Unsplash)

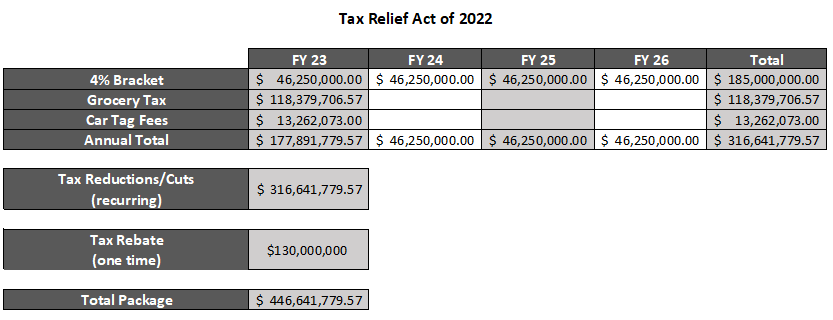

Committed to cutting taxes without any offsetting increase, Lt. Governor Delbert Hosemann and Senate Finance Chairman Josh Harkins unveiled a $446.6M tax relief package today.

The proposal includes:

- An immediatereduction in the grocery tax from 7 percent to 5 percent, at a cost of about $118.4 million;

- An immediate elimination of the state’s fees on car tags going to the general fund, to the tune of an estimated $13.3 million;

- A 2022 rebate of up to $1,000 for citizens with tax liability, which totals about $130 million; and

- The elimination of the 4 percent tax bracket over the next four years, at a cost of $185 million.

“Around the kitchen table, Mississippi families are talking about the significant impact of inflation on the cost of groceries and other goods and services which are necessities in daily life,” Hosemann said. “The Senate’s plan is sustainable and directly tackles inflation without increasing any taxes.”

The Legislative Budget Office and Mississippi Department of Revenue have vetted the numbers in the Senate plan. Harkins plans to bring the bill before the Senate Finance Committee in the coming weeks.

“Mississippi has had a record year in terms of revenue, so it was imperative to me we develop a durable tax relief plan which returns taxpayer money to taxpayers without raising any rates,” Harkins said. “The most important thing we can do as conservatives is get this right—and this plan allows for a substantial cut while still balancing the budget.”

In total, the Senate’s proposal would eliminate more than $316.6 million in recurring revenue from the budget by 2026. In 2016, the Legislature passed a bill phasing out the 3 percent tax bracket by 2022. The same legislation phased out the franchise tax on businesses over a ten-year period ending in 2028.

“Governor Reeves and legislators gave us a great roadmap on how to do this with the 2016 tax cut package,” Harkins said. “We intend to follow that lead.”

Revenue for the last fiscal year (FY 2021) and current fiscal year (FY 2022) are above projections, but budget analysts have advised revenues are likely buoyed by the significant federal recovery funds flowing into the state. This makes it difficult to discern how much revenue is one-time and how much is recurring.

Additionally, both the House and Senate have made recommendations for additional spending on necessities, including a $200 million-plus pay raise for teachers across the state. The Senate position accounts for these promises and the instability in the economy.

“We need to continue to trim the fat while taking care of the core functions of government, including funding our schools and infrastructure. I believe we can responsibly accomplish both of these goals,” Hosemann said.

For more information about Lt. Governor Delbert Hosemann, visit www.ltgovhosemann.ms.gov.