Workshop explores funding options for entrepreneurs

Published 11:33 am Tuesday, September 19, 2023

By Wayne Andrews

In the bustling landscape of small businesses, securing funds for growth and expansion is a constant challenge. However, entrepreneurs today have access to a diverse range of funding options, from traditional small business accounts to cutting-edge incubators and the support of angel investors.

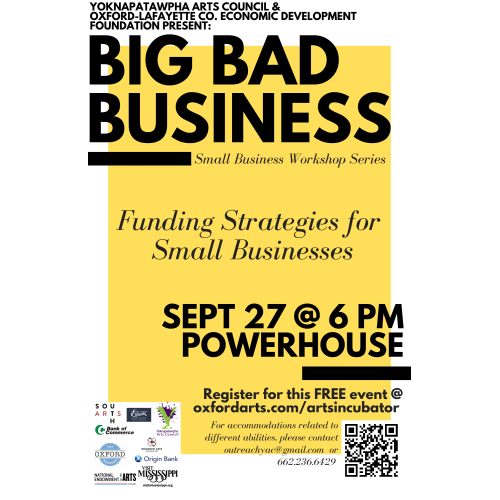

The monthly free workshop series sponsored by the Yoknapatawpha Arts Council and Oxford Lafayette Economic Development Foundation will dive into these distinct avenues for financing, each with its unique advantages and considerations.

The workshop is being offered free and open to the public on Sept. 27 at the Powerhouse Community Arts Center and will feature speakers from Renaissance Community Loan Fund, Three Rivers Planning and Development, and members of regional Angel Funds.

Small business accounts serve as the bedrock of financial stability for many startups and small enterprises. They offer various advantages, including the following:

- Simplicity: Opening a small business account is straightforward and ensures separation between personal and business finances, crucial for maintaining financial clarity.

- Credit Building: Consistent use of these accounts can help build business credit, which may be essential for securing future loans or lines of credit.

- Loan Eligibility: Maintaining a healthy account can enhance eligibility for small business loans offered by banks or the Small Business Administration (SBA).

While small business accounts are a practical starting point, they may not provide substantial funding for significant expansion.

Angel investors are high net worth individuals who provide capital to startups in exchange for equity. These funds offer more substantial financing options, including the following:

- Strategic Guidance: Beyond capital, angel investors often bring industry expertise and connections that can be invaluable to startups.

- Flexible Terms: Angel investors typically offer more flexible terms compared to traditional lenders, allowing for customized agreements.

- Long-Term Vision: Angels are often willing to invest in early-stage companies with a long-term vision, even if profitability is not immediate.

However, securing angel funding can be competitive, as investors seek promising opportunities with high growth potential.

Building a compelling pitch and network is crucial for success in this realm. Incubators are organizations that support startups by providing resources, mentorship and, sometimes, direct funding. Here’s why they’re gaining popularity:

- Comprehensive Support: Incubators offer a range of resources, from office space and equipment to expert guidance and mentorship, which can significantly accelerate a business’s growth.

- Networking: Joining an incubator often means access to a network of entrepreneurs, investors and industry experts, fostering collaborations and partnerships.

- Investment Opportunities: Some incubators also invest directly in startups in exchange for equity, giving businesses both financial support and a nurturing environment.

The financial landscape for small businesses is more diverse than ever, with options ranging from basic small business accounts to the strategic backing of angel investors and the nurturing environment of incubators.

While each avenue has its benefits and challenges, savvy entrepreneurs often explore a combination of these options to secure the funds needed for growth and success.

Small business owners should carefully evaluate their unique needs and goals to determine which financing approach aligns best with their vision. In this dynamic landscape, securing the right funding can set the stage for remarkable business growth and sustainability.